PropEA Extended FAQs

An extensive list of the most frequently asked questions with detailed answers.

PropEA Support Team

Last Update vor 2 Jahren

1. How does PropEA work?

2. What’s the pass rate of PropEA?

PropEA utilizes a well calculated hedging strategy that will either pass your challenge or recover the cost of the challenge, so you don’t have to pay for your next attempt. Therefore, the pass rate is ultimately 100%.

3. How much should I have in my live account to run PropEA?

The live account should be funded with 3x the cost of the challenge if it's 2 phases, and 2x the cost if it's 1 phase.

Example:

| Challenge Type | Cost | Multiplier | Live Account Size |

| 2-Phase (2-Step) | $500 | 3 | $1,500 |

| 1-Phase (1-Step) | $500 | 2 | $1000 |

4. Does PropEA work with any Prop Firm?

PropEA works with any prop firm that allows EA trading, and doesn’t apply a Consistency Rule or Trailing/Relative/Smart Max Drawdown.

5. Can I use my PropEA license on multiple Prop challenges?

Yes, but ONE challenge at a time. The license is linked to your live account, not the prop account, which means once you finish with a challenge, you can run the EA on a new challenge as long as your license is valid.

Important: Don’t run the EA on a new challenge until you finish the current challenge.

6. Can I use PropEA on the funded account after passing?

Yes, you can run PropEA on a funded account after passing. Here is an example with caluculations:

| Funded Account Size | Max DD | Payout % | Live Account Size |

| $100,000 | $10,000 | 90% | $3,000 |

In this example, the actual value of the funded account is not $100k, it is the maximum allowed loss (Max DD), which is 10%, that's the amount over which you have control.

So let's say you've got $10,000 in the funded account, and $3000 in your live account

PropEA will start trading on both accounts, aiming to double the value of either account.

If it doubles the value of the funded account, you would make $10,000 of which you can withdraw about 90% ($9,000) and lose $3000 on the live account.

In that case, your net profit would be: $9000 - $3000 = $6000

If it doubles the value of your live account, you would make $3000 on top of your initial $3000.

In that case, your net profit would be $3000.

7. Can I run PropEA on an ongoing challenge with trade history?

Yes, but the EA settings must be adjusted to reflect the current status of the account. It's recommended to contact our support team to help you adjust the settings, providing the following details:

- Challenge Type: (1-phase or 2-phases)

- The current account balance.

- The Challenge Cost.

- Daily DD Rule

- Max DD Rule

- Target Rule

8. What instruments/pairs should I trade with PropEA?

Any trading instrument that is available on both terminals (Prop and Live), but always look for instruments with:

- Low Spread

- Low Swap Rates

- Relatively High Volatility

9. Is there a leverage requirement for PropEA to work?

No, but the higher the better. If the leverage on your Prop or Live account is lower than 1:50, it is recommended that you change the “Trade Mode” in your EA settings to “Normal” or “Slow” if you’re having an “Insufficient margin” error.

10. Can I trade manually on my Prop account?

Yes, you can trade manually on your Prop account in conjunction with PropEA, but with the following precautions:

- Before you place a manual trade, go to the EA settings on your Prop account, and switch “Auto-trade” option to “false”.

- Don’t place any trade on your live account manually, the EA will hedge automatically.

- Try to place 1 trade at a time so you don’t incur more cost in spread, commission, or swaps.

- You may follow the EA lot projection, but always make sure that the trade size is in line with your accounts’ leverage and margin requirements.

- Trade only one symbol, which is the symbol to which you attached the EA and defined in Symbol Mapping.

- Don't place any SL or TP on the trades, it will be handled by PropEA.

11. Can I run PropEA in conjunction with another EA?

Yes, you can use another EA with PropEA at the same time, but please keep the following in mind:

- Before you run the other EA, go to the PropEA settings on your Prop account, and switch “Auto-trade” option to “false”.

- Don’t place any EA on your live account, the PropEA will hedge automatically.

- The other EA should not place any SL or TP.

- The other EA should be attached to the chart of the same symbol as PropEA.

Yes, no problem at all. PropEA doesn't require the Metatrader terminal editions of the Prop account and the Live account to be the same

13. To which timeframe should I attach the EA?

Any chart timeframe, the timeframe doesn't have any impact the EA's logic.

14. How long does the EA take to fail or pass a challenge?

It depends on the market volatility, the challenge rules, and the accounts leverage, it could take up to 3-4 weeks to pass the 2 phases.

15. What is the difference between PropEA pricing plans?

The only difference between the Starter, Advanced, and Ultimate plans is the duration of the EA license.

16. How does the Managed Plan work?

Challenge Stage:

Fees: $349 in advance.

Duration: There is no limit on the duration, so we'll keep trying until we pass.

Funded Account Stage:

Fees: If you already have a funded account or would like us to continue managing the account after passing, then we would charge 25% as a performance fee. However, a refundable collateral of 1% of the funded account size should be paid in advance.

Minimum: The minimum managed account size is $200k.

17. Will PropEA automatically place orders to fulfil the minimum number of trading days?

Yes, PropEA places trades automatically to fulfil the minimum number of trading days.

18. I accidentally closed a trade on my Prop account manually, do I need to change any settings?

No, the EA will open a new trade in a while, just make sure the trade on the live account was also closed automatically.

19. I accidentally closed a trade on my Live account manually, do I need to change any settings?

No, the EA will close the original trade on the Prop account and open a new trade in a while, just make sure the trade on the Prop account was also closed automatically.

20. How long does the EA take to start trading?

It takes 10 Minutes for PropEA to place its first trade unless you run it 2 hours or less prior to rollover time, then it will wait until 2 hours have passed after rollover time to avoid swaps and high spreads.

21. What is the best time to run PropEA?

Avoid Wednesdays and Fridays so you don’t incur extra swap and spread costs.

22. If I place a trade manually on my Prop account, will PropEA execute hedging automatically in my real account with the correct lot size?

Yes, it will, you don’t need to do anything on the Slave (real/live) account.

What drawdown types does PropEA support?

PropEA supports the following Daily Drawdown types:

- Balance Drawdown (Based on Rollover Time)

- Equity Drawdown (Based on Rollover Time)

- Balance & Equity Drawdown (Whichever is higher based on Rollover Time)

Please note that the current version doesn't support Trailing/Relative Max Drawdown type.

23. Can I attach the PropEA to multiple charts?

No, attach it to one chart of the instrument that you want it to trade.

24. Can I change the EA's magic number

Yes, it's recommended to change it on the Prop account only, but the magic number on the Slave (real/live) account will be set automatically by PropEA

25. Can I test PropEA on a demo account first, and do you offer a free trial?

Yes, you're encouraged to test PropEA on demo accounts until you're satisfied to switch your license to a live account.

When you purchase any license plan of PropEA, you will receive a 2 week free extension on your license duration so you have enough time to test on demo accounts without losing time from your paid license.

26. What is the difference between your pricing plans?

We offer the following plans:

Starter (3 month license):$399

Advanced (6 month license):$499

Ultimate (12 month license):$749

The only difference is the license duration. The license is linked to your live account, not the prop account, which means once you finish with a challenge, you can run the EA on a new challenge as long as your license is valid.

But it works with 1 challenge at a time, so the longer the license duration, the more challenges you can take.

27. Was this EA tested properly?

Yes, PropEA has been tested thoroughly on various challenges and Prop firms, both internally and by 3rd party users.

28. Can I see real results from your users?

Sure, we regularly post results of our users on our official Telegram channel.

Below you will find some real examples from our users:

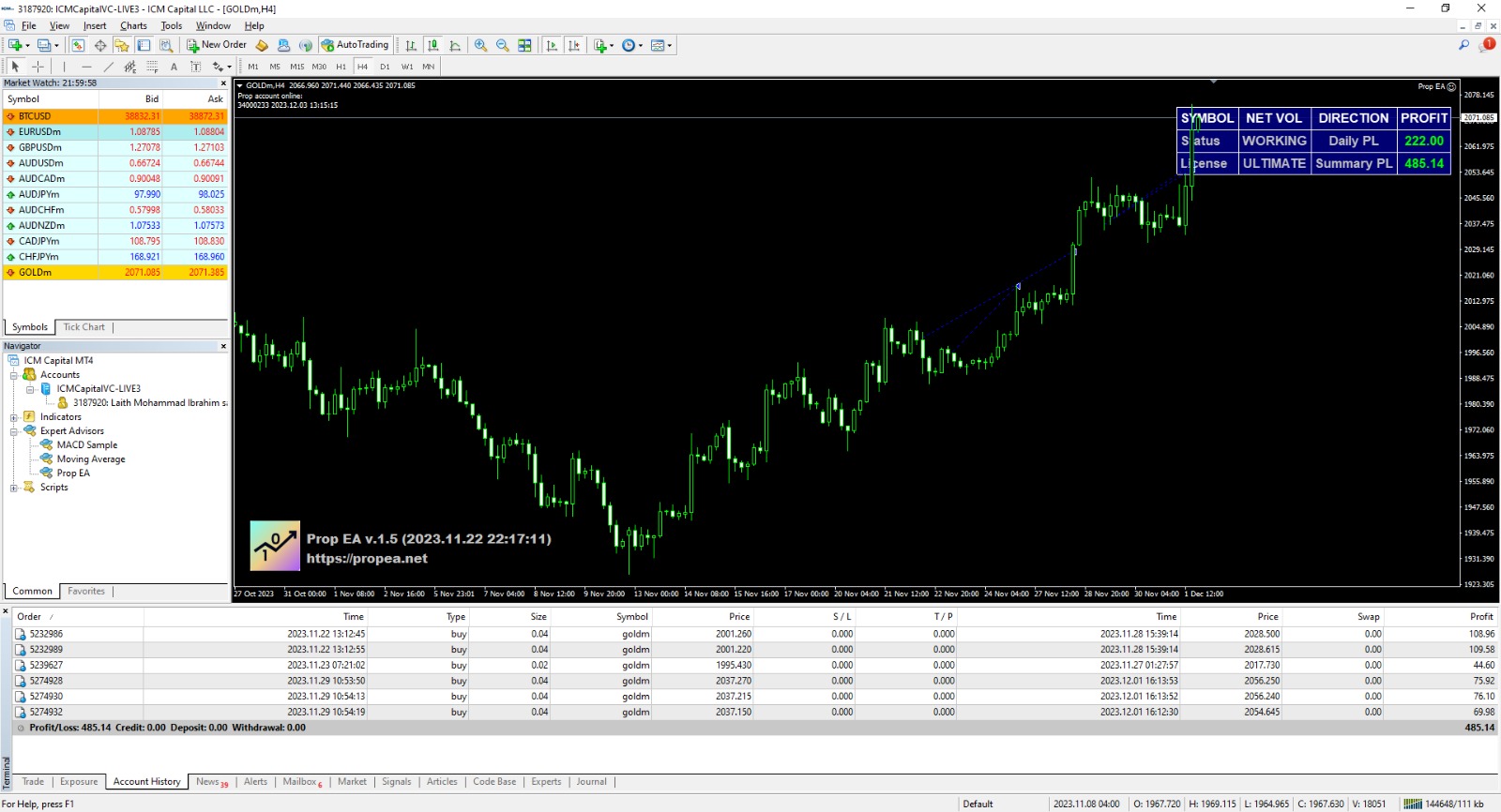

Example 1: Cost Recovery

🔹$100K Challenge

🔹Ultimate Traders

🔹Cost: $500

🔹Recovered Amount: $485

The challenge is not lost yet, and it recovered 97% of the cost.

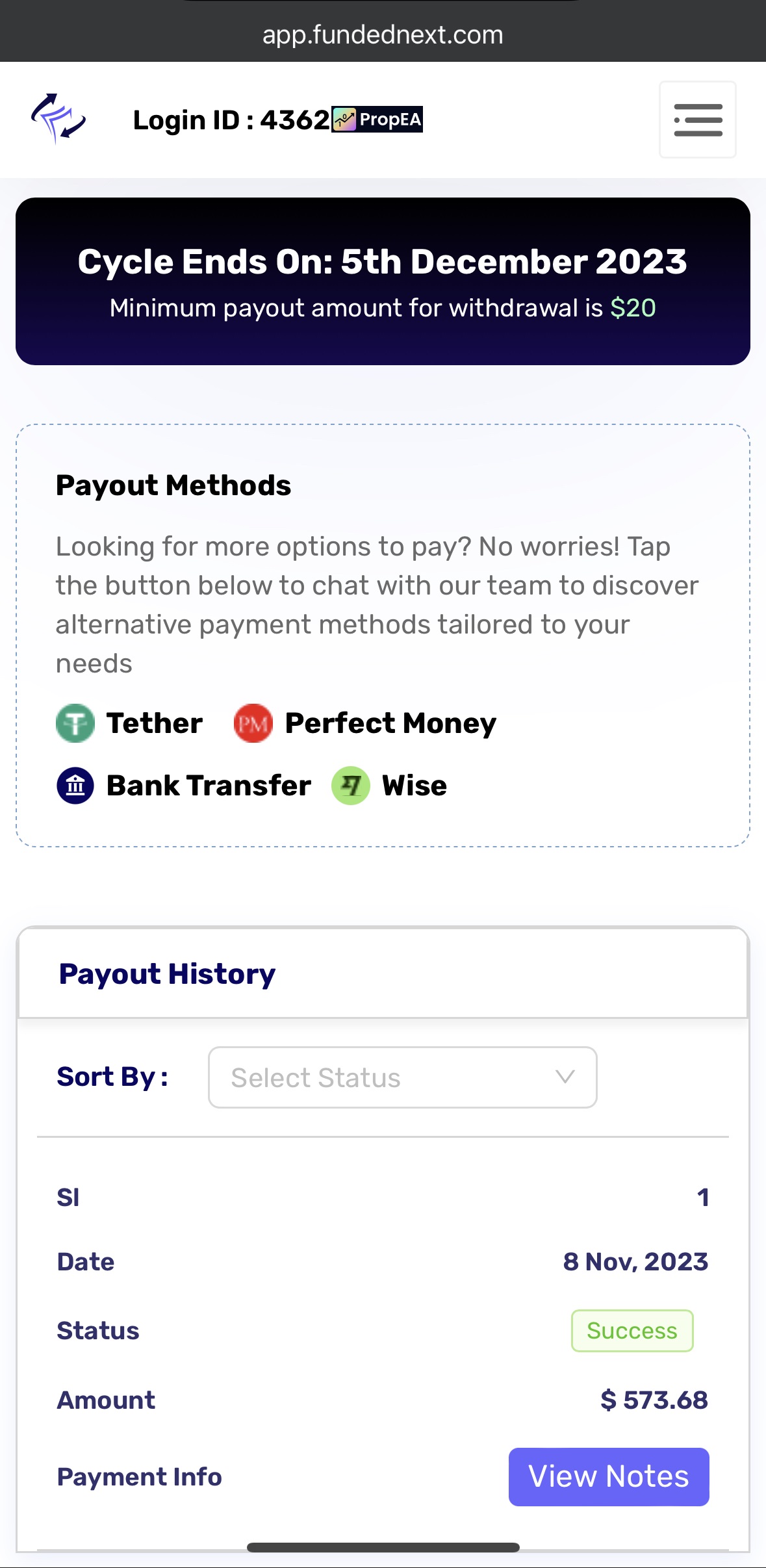

Example 2: First Payout

🔹$6K Funded Account

🔹FundedNext

🔹1st Payout: $573